View cTCC

The Electronic Tax Clearance Certificate

The Electronic Tax Clearance Certificate (e-TCC) is a new system of issuing tax clearance certificates in Lagos State. It replaces the old paper and manually processed Tax Clearance Certificate (TCC). The e-TCC is a project embarked upon by the Lagos State Government to remove the abuses, which characterised the administration of the old TCC in the state. The abuses included:

- Lots of fake Tax Clearance Certificates (TCC) in circulation

- Loss of revenue by the State due to large scale fraud and malpractices

- Tax evasion

- Delay in issuing TCC to Taxpayers

- Poor identification of taxpayers

Objective

The objective of the e-TCC project is to increase the Internally Generated Revenue (IGR) of the State through:

- Pay As You Earn (PAYE)

- Direct Assessment of Individual Taxpayers

- Capturing of more Taxpayers into the Tax Net

Benefits

The e-TCC project has many benefits to both the State Government and individual taxpayers:

| Benefit to lasg | Benefit to Individual |

|---|---|

| Identification of Taxpayers | Serves As Identity Card to the Holder |

| Elimination of fake Tax Clearance Certificates (TCC) in circulation | Data Integrity |

| TaxPayer Enumeration | Reinforces Taxpayer Assurance that all Payments would be remitted to the Government Coffers by the various Agencies |

| Attraction of more Taxpayers to the Tax Net | Card is Durable and Portable |

| Easy Reconciliation of Tax Returns | Provides Easy Access to Taxpayer Payment History |

| Total remittance of all collected revenues into Government coffers | Eliminates Delay in obtaining TCC |

Goals Achieved

Several goals have been achieved in the e-TCC project.They include:

- Development of an Application Form

- Installation of Information Technology Facilities such as Computers, Printers, Internet Access and Generators at the Tax Stations

- Distribution of Customised Terminals/Card Readers to designated places and Tax offices

- Maintenance of Database to Ensure Data Integrity

- Staging of Vigorous Enlightenment Campaigns to Create Public Awareness

- Training of Resource Persons for the Project

- Continuous Cost-benefit Analysis of the Project

- Gathering of Accurate and Timely Taxpayers Data

- Provision of Logistic Support for the Project

- Identification of Project Implementation Team/Committee

Data Capture by Banks

Accurate data supplied by both the banks and taxpayers are crucial to the success of the project. The banks are to:

| 1. | Capture Accurate Taxpayer Information at the Point of their making Payments at the Banks |

| 2. | Ensure that all Taxpayers Accurately complete the Necessary Fields on the Deposit Slips |

| 3. | Capture Accurate Taxpayer Data before Transmitting them into their Systems and Subsequently to ABC |

| NOTE | Inaccurate Information from either Taxpayers or Banks will delay the Processing of the e-TCC or outright cancellation of receipt. Banks that Fail to comply with the Foregoing directives would be advised to withdraw from EBS-RCM scheme. |

Process Flow

The Process Flow of e-TCC project is as follow:

| TaxPayer | designated banks | Tax Audit Monitoring Agents | lirs headquarters |

|---|---|---|---|

| Remits taxes at a designated bank | Acknowledge remittances made by taxpayers by reporting them to ABC via Internet or diskette | Carry out tax audit of companies to capture all employees and individuals into the tax net | LIRS/ABC distribute e-TCC application Forms, Form A, Form H1, Form L1 and Form H2 to all companies through Tax Stations/Revenue Centres |

| Obtains receipt from banks | Give additional information to ABC on Taxpayers (if necessary) | Ensure that e-TCC Application Forms of audited companies/individuals are collected, completed and returned to relevant Tax Stations/ABC | Advise all companies to apply for e-TCC on behalf of their employees; also advises self - employed Taxpayers to apply for e-TCC |

| Applies for e-TCC | Obtains receipt from ABC on behalf of Taxpayers | Ensure that the companies pay the tax liabilities arrived at during the audit process into designated bank accounts and that the companies complete Form H1 while their employees complete Form H2 (supply information in Forms H1 in electronic copy) | In cases of non-compliance, serve the affected companies/individuals with audit notifications |

| Pays additional assessment ( if necessary) | Deliver receipts to Taxpayers | Advise the companies to apply for Tax Audit Clearance Certificates after the payment of Tax liabilities arrived at during Tax Audit process | Approve the issuance of e-TCC to the applicants |

| Obtains e-TCC from Tax Station | Tax Monitoring Agents (TMA) ensure that Individuals within their areas of operation apply for e-TCC |

| Tax Stations | tax authority | Alpha-Beta Consulting Limited (ABC) |

|---|---|---|

| Cross check submited form to ensure the correctness and accuracy of all documents attached to e-TCC Form by an applicant | Determines level of compliance by Taxpayers | Acknowledges tax remittances from Bank |

| Ensure that adequate remittances have been made by an applicant or on behalf of an applicant based on Forms H2 and A | Raises additional assessment (if necessary) | Delivers taxpayers receipts to the Banks |

| Confirm adequacy of remittances especially of the current year by the Audit unit | Forwards Taxpayer Application Forms to ABC | Collects approved application forms, Form H1 and Form H2 from Tax Stations for processing |

| Make additional assessment if necessary and ensure that payment is made by the applicants | Advises ABC to produce e-TCC for Taxpayers | Captures the data of all Applicants into e-TCC database using the completed application forms, Form H1 and/or Form H2 |

| Receives processed card from ABC | Follows up the collection of e-TCC application forms, Form H1 and Form H2 with companies which fail to submit at Tax Stations | |

| Issuing Authority completes the Official section of e-TCC Application form | Produces e-TCC for applicants and uploads tax remittance history on the card chips | |

| Delivers processed cards to applicants | Delivers fully processed cards to Revenue Centres and relevant tax offices/companies |

Guidelines For Application

A set of guidelines for both Pay As You Earn (PAYE) and non-Pay As You Earn applicants for the e-TCC has been outlined

| PAYE Applicants | Non-PAYE Applicants |

|---|---|

| Complete Form A obtained from the Lagos Internal Revenue Service (LIRS) at the beginning of the year | Complete the e-TCC application form obtainable from designated centres in the state such a |

| Complete the e-TCC application form obtainable from designated centres in the state such as: | Tax Stations/Revenue centres |

| Tax Stations/Revenue centres | LIRS headquarters, or, |

| LIRS headquarters, or, | Downloaded from the EBS-RCM website (www.lagos.ebs-rcm.com) |

| Downloaded from the EBS-RCM website (www.lagos.ebs-rcm.com) | Attach photocopy of Assessment Notice |

| Attach completed and certified Form H2 and passport photographs with name written at the backside | Attach photocopy of Receipt as evidence of tax remittance |

| Submit the documents to the Tax/Revenue centre where the employer is registered | Attach passport photograph with full names written at the back |

| Check back after 72 hrs to collect e-TCC | Submit all documents at the Tax Station/Revenue Centre where taxpayer is registered |

| Check back to collect card after 72 hrs |

Provision of Infrastructures

The State Government provides the following infrastructures at the Tax Station

- Computers

- Printers

- Generators

- Internet Access

Note Where the State Government fails to provide the above facilities, ABC would provide them in order not to delay the project

e-TCC Customisation

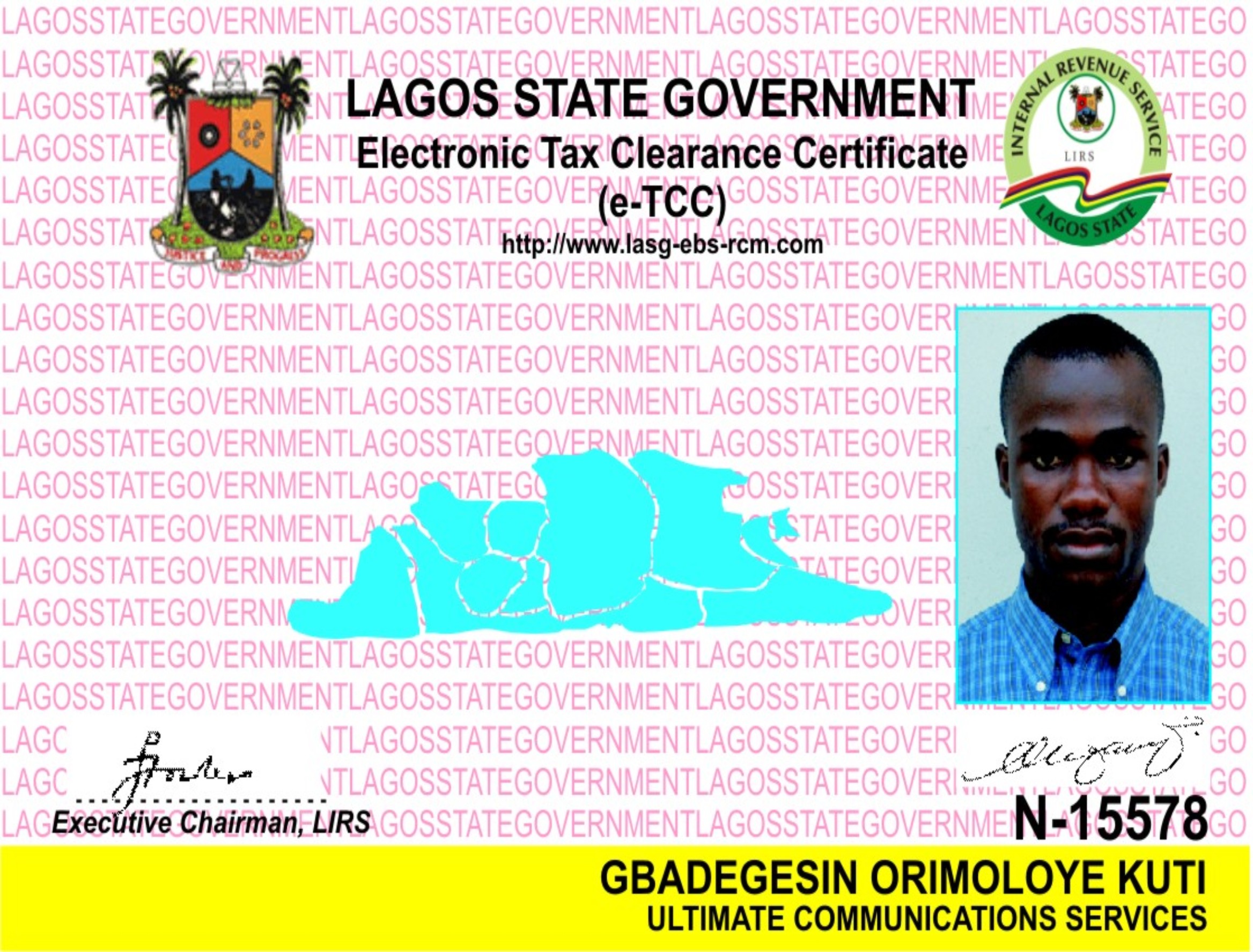

The card has the following features:

- A hybrid card system comprising a smart chip on the front and a magnetic strip at the back

- Carries a picture of the taxpayer and the logo of the State and the Coats of Arms

- Interfaces with terminals on database through web-enabled and customized Application Programming Interfaces (API) running on window 2000/XP

Publicity and Enlightenment Campaigns

The Lagos State Government stages public enlightenment and awareness campaigns to educate and enlighten the public on:

- The introduction and continuous use of e-TCC as a replacement for the paper-based TCC

- Importance of supplying accurate information by taxpayer when completing the e-TCC application form, the deposit slips at the designated banks when remitting taxes.

e-TCC sample card